Bitcoin halving

- The upcoming fourth Bitcoin halving is scheduled around April 19, 2024.

- It will reduce the miner reward from 6.25 to 3.125 BTC, escalating the scarcity and demand for Bitcoin.

- Market optimism that could drive prices towards and possibly above the $100,000 threshold.

The Bitcoin world is on the cusp of a significant event – the fourth Bitcoin halving, expected to occur around April 19, 2024.

This pre-programmed mechanism, embedded in Bitcoin’s DNA, cuts the block reward for miners in half, significantly impacting the rate at which new Bitcoins enter circulation. But what exactly is the halving, and how might it affect Bitcoin’s future?

What is the Bitcoin Halving?

Satoshi Nakamoto, the creator of Bitcoin, designed a system with a finite supply of 21 million coins. The halving mechanism was ingrained in the Bitcoin protocol to prevent inflation and maintain a secure network.

The reward for miners validating transactions gets halved every 210,000 blocks mined (roughly every four years). This incentivizes miners to secure the network while ensuring a predictable and limited supply of Bitcoin.

What Happens to Bitcoin Price After Halving?

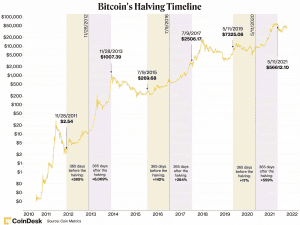

Significant price increases for Bitcoin have followed previous halvings. Here’s a historical glimpse:

2012 Halving

- Pre-halving price: Approximately $2.54, 365 days before the event.

- Halving date: November 28, 2012, reduced the reward from 50 BTC to 25 BTC.

- Post-halving increase: An astounding +8,069% growth, with Bitcoin’s price surging over the next two years, cresting at about $1,100.

2016 Halving

- Pre-halving price: Around $269.68 a year before the halving.

- Halving date: July 9, 2016, the miner’s reward dropped from 25 BTC to 12.5 BTC.

- Initial reaction: Slight price dip, typical of pre-halving market behavior.

- Subsequent bull run: After the dip, Bitcoin witnessed a colossal increase of +2,848%, reaching nearly $20,000 in late 2017.

2020 Halving

- Pre-halving price: $7,306.17, one year before the halving.

- Halving date: May 11, 2020, the reward halved again to 6.25 BTC.

- Pandemic context: Occurred during a global economic downturn due to the COVID-19 pandemic.

- Price rally: Despite the turmoil, Bitcoin’s price achieved a monumental rise of +559%, hitting a new all-time high of over $73,000 by March 2024.

Why Does Bitcoin Halving Increase Price?

Market Patterns and Analysis

- Predictable scarcity: Each halving cuts the Bitcoin block reward in half, decreasing the rate at which new bitcoins are generated and thus increasing scarcity.

- Miner incentive: Reduced block rewards increase the cost of mining each Bitcoin, often pushing the market price up as miners seek profitability.

- Historical trends: Post-halving periods are generally marked by an increase in Bitcoin’s price, though not immediately after the event.

- Investor anticipation: As halving approaches, retail and institutional investors tend to increase their holdings, anticipating price growth.

Comparative Market Effects

- Pre and post-halving volatility: Markets typically experience volatility before and after the halving as traders and investors speculate on the impact.

- Long-term gains: Significant long-term gains have been observed after each halving, with the percent increase generally in the triple digits.

- Market maturity: With each successive halving, Bitcoin’s market capitalization grows, reflecting increased adoption and market maturity.

- Influence on altcoins: Bitcoin halving also tends to affect the wider cryptocurrency market, including altcoins, as investors recalibrate their portfolios.

Implications for Future Halvings

- Anticipated fourth halving: Scheduled for around April 19, 2024, expectations are high for the impact on Bitcoin’s price.

- Market indicators: Large-scale accumulation by whales and rising demand from long-term investors suggest a bullish outlook.

- Miner economics: The average mining cost per Bitcoin is a significant factor in post-halving price predictions, emphasizing the need for higher market prices to sustain miner operations.

Post-Halving Bitcoin Price Performance

Coin Metrics data reveals interesting trends following the 2nd and 3rd halvings. Within a month, Bitcoin price dropped 6% post-2nd halving but surged 13% post-3rd halving. Prices displayed a similar pattern over 3 and 6 months, with significant gains post-3rd halving compared to the 2nd.

Notably, 9-month returns after the 2nd and 3rd halvings were 94% and 458%, respectively. These figures suggest a potential for substantial long-term gains in Bitcoin prices following the upcoming halving event.

When Is Next Bitcoin Halving?

With approximately 12,000 blocks remaining as of April 15, 2024, the countdown to the fourth Bitcoin halving is on. This pre-programmed scarcity mechanism is expected to occur around April 19th, 2024, and slash the reward from 6.25 Bitcoin to 3.125 Bitcoin per block.

Whales Accumulate, Signaling Bullish Sentiment

As the fourth halving approaches, crypto analytic firm CryptoQuant reveals a notable surge in Bitcoin accumulation by large investors, known as whales. This trend underscores bullish sentiment in the market as the halving event nears. The heightened demand from whales, coupled with increasing spot Bitcoin inflows, suggests a potential price increase for the cryptocurrency.

Additionally, rising demand from long-term investors outpaces the available supply, indicating a growing scarcity that will likely intensify post-halving. Historically, Bitcoin halvings have triggered significant price rallies due to reduced supply and increased demand, as discussed earlier.

Moreover, halvings impact miners, requiring higher BTC prices to maintain profitability. Currently, the average mining cost per Bitcoin stands at $49,000, emphasizing the necessity of prices exceeding $80,000 post-halving for miners to sustain profitability. This whale accumulation phase paints a promising picture for the crypto market, anticipating a potential price surge shortly.

Crypto Experts Discuss Bitcoin Halving

Industry leaders like Marathon Digital CEO Fred Thiel anticipate the Bitcoin halving event. In a recent interview with Bloomberg, Thiel discusses the potential catalysts for further price increases and their impact on the mining industry.

While he acknowledges the historical trend of price appreciation following halvings, Thiel suggests the recent surge in Bitcoin ETFs might have already priced in some of the impact by attracting significant capital to the market. However, historical data and market pundits remain optimistic, with some setting price targets at the coveted $100,000 level.

How Crypto Mat

As the fourth Bitcoin halving draws near, with just about 12,000 blocks left until the event around April 19, 2024, anticipation builds within the cryptocurrency community.

Reducing the mining reward from 6.25 to 3.125 Bitcoins per block not only tightens supply but also intensifies demand, particularly from large-scale investors or ‘whales’ who are actively increasing their holdings. Historical data from Coin Metrics highlights that post-halving periods have traditionally resulted in substantial price increases, with the price post-2020 halving escalating to a record high of over $73,000 by March 2024.

The combination of reduced supply and robust whale activity suggests a strong bullish outlook. Given the current average mining cost of $49,000 per Bitcoin, prices would need to surge past $80,000 post-halving to sustain miner profitability.

With major financial analysts and industry leaders eyeing price targets around the $100,000 mark, the upcoming halving could catalyze another monumental rally in Bitcoin’s valuation. Such a surge would benefit long-term holders and reinforce Bitcoin’s position as a leading digital asset in the global financial landscape.

Latest News

Most Popular News

- ATT Data Breach Sees Over 70 Million Records Leaked

- Microsoft Engineer Foils Major Linux Backdoor Plot

- AT&T 70M User ‘Data Breach’ Record: Experts Set the Record Straight

- Zoom Rolls Out AI Features to Redefine Workplace Collaboration

- Nintendo Switch 2: Leaks, Rumors, And Everything Else We Know So Far

- The Day Africa Lost Internet: Undersea Cable Disruptions and the State of Global Connectivity

- Reddit Floats New Theory About True Identity of Bitcoin Creator Satoshi Nakamoto

- Reddit Stock Soars, But It Might ‘Not Make Users Happy’, Analysts Warn

- Is Intel’s Gaudi 3 AI Chip a Market Disruptor or Too Little, Too Late? Expert Analysis

- Meme Coin Season Continues as $BOME Surges 1,800% in a Week

Comments

Post a Comment